Build Your Own High-Yield Savings Account

I've been dipping my toes into Decentralized Finance(DeFi). In my opinion, the gains are real but temporary. I've been trying to map out the easiest path to roll your own high-yield savings account.

Here's what I came up with:

How To Set Your High-Yield Savings Account

1. Set up an Account on Coinbase

You'll use Coinbase to convert your money into crypto. You'll hold what is called a "stablecoin", a form of cryptocurrency where 1 token = $1 USD in value.

2. Get a Phantom Wallet

A wallet is both a place to store tokens and your ID card on crypto applications. Note the passphrase you get and keep a copy in a secure place. You'll be using the Solana blockchain, which the Phantom wallet uses.

3. Buy Some Solana on Coinbase

As much as you feel comfortable with. You won't be holding this for long and soon you'll be converting it into stablecoin. You will incur a small fee. You can pay a smaller fee by using Coinbase Pro but it's a bit more complicated.

4. Transfer your Solana to your Phantom Wallet

Copy the address from your wallet and paste it into Coinbase's send/receive feature.

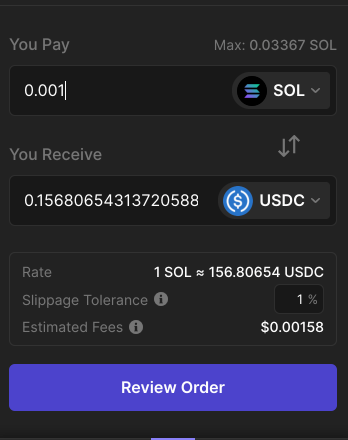

5. Convert Your Solana to stablecoin (USDC-SL)

You can do this using the swap feature in your wallet. This is the 'stablecoin' that will keep your money in. This way you're protected from the fluctuations of the frothy crypto market.

6. Lend your stablecoin on tulip.garden

Go to https://tulip.garden, let's lend some money! · log in with your wallet · go to lending and deposit your stable coin. As of this writing, you can get 16% APY as of this writing, but be aware the rates are highly variable.

When you're ready to withdraw

Same process as above, in reverse.

- withdraw your loan

- convert to USDC -> SOL

- send SOL -> Coinbase

- withdraw into your bank account

What are the risks?

Cryptocurrency accounts are not insured, so if something were to happen to your account you're out of luck. You need to be careful with your wallet, to ensure that you, and only you, maintain access to it. There's always a chance something could happen to Tulip Garden or the Solana chain, making it difficult or impossible to liquidate your position.

Having said that, I do this with some of my own money and have trust in the companies and technologies involved here. But do your own research before investing any of your own money.

How are rates this high?

You might be wondering, how are these rates possible? The short answer is that there is a lot of capital pouring into the space & new exchanges and apps offer rewards to incentivize adoption.

How did Uber get started? paying drivers a big fee, and giving away free rides Think of the current state of DeFi like that. Early Uber drivers could make bank. The same holds true for early DeFi adopters.

Here's Nat Eliason's take on "how are yields so high?"

In almost all cases, they're coming from "incentivized liquidity pools." A method of launching new tokens that can be done with a conservative long-term plan, or with a "live fast and die young" hyper-aggressive schedule where they're praying the demand outpaces their insane inflation rate.

Other investors do something called 'leverage farming' where they invest tokens, borrow against them, re-invest what they borrow, etc. This practice causes the high yields from incentivized liquidity pools to flow down to simpler financial instruments, like private lending.

(By the way, I got my start in Decentralized Finance (DeFi) with Nat's course, I highly recommend it: DeFi Orientation)

Or, if you have any questions about this kind of thing, feel free to hit me via email or on Twitter

This post is not investment advice and is for entertainment and informational purposes only.

Do your own research.

wagmi